Let American Family Funding Group Work for you. Our office has over a 100 years combined experience in the mortgage industry. Let us find the best type of loan that fits your needs.

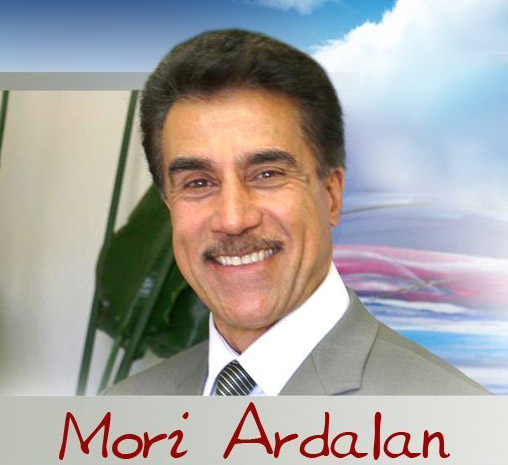

mori ardalan

At American Family Funding Group, we have experienced in-house processing staff.

+ We offer all FNMA, Freddie Mac loan products, FHA, VA loans and first time home buyers program.

+ We also offer Non QM loans, such as Reverse Mortgage, and Hard Money loans, Bank statement and stated income loans

+ We have access to the Best and the Most Competitive Rates in the industry. We are affiliated with tens of Mortgage Banking companies, Banks, Credit Unions, and other Lending Institutions.

+ We can help you with your Pre, approval, will also help you find the best loan program.

+ We will help you from the loan Application to Closing of your loan.

Apply Online at American Family Funding Group, Secure website, and get Pre-Qualify in minutes

WHAT DO I NEED TO QUALIFY

THE FOLLOWING INFORMATION IS USUALLY REQUIRED DURING THE LOAN PROCESS:

- Your Social Security Number and Drivers Licence Number

- Current paycheck stubs and your fedral tax returns for the past two years- All Pages

- Bank statements for the past two months, IRA and 401K Statements -All Pages

- Investment account statements for the past two months

- Life insurance policy

- Retirement account statements for the past two months

- Make and model of vehicles you own and their resale value

- Credit card account information

- Auto loan account information

- Personal loan account information

IF YOU CURRENTLY OWN REAL ESTATE:

- Latest Mortgage Statements

- Home insurance policy information

- Home equity account information (if applicable)

American Family Funding Group – Mori Ardalan:

+ FIXED-RATE MORTGAGE

With a fixed–rate mortgage, you’ll always know what your monthly principal and interest payments will be. You can also lower your monthly payments by spreading them out over a long period of time.

+ ADJUSTABLE-RATE MORTGAGE

ARMs offer lower early payments than a fixed–rate mortgage. They may also give you the opportunity to take advantage of lower rates in the future. If you’re planning on owning your home for a short period of time, an ARM may be a good option.

+ JUMBO MORTGAGE

Jumbo Mortgage loan amounts are available from $417,000 to $2 million (or more depending on your property location)

+ FHA MORTGAGE

FHA mortgages include a down payment as low as 3.5% and flexibility, if you have “less than perfect” credit.

+ HOME AFFORDABLE REFINANCE PROGRAM (HARP)

Created by the federal government, HARP makes it easier for eligible homeowners to refinance their homes to a lower mortgage rate. It’s unique because you can refinance even if you owe more than your home is worth. You may not need to provide as much documentation, and the approval time may be faster than a traditional refinance.

+ VETERANS AFFAIRS

VA loans have little or no down payment requirements, no monthly mortgage insurance and provide up to 100% financing.

+ CONFORMING LOAN

A conforming loan meets certain guidelines as set forth by Fannie Mae and Freddie Mac. The best-known of these guidelines is the size of the loan; in most counties in the United States, the current maximum size of a conforming loan is $417,000, though super-conforming loans with higher price limits are available in more expensive counties.

Direct: 408-297-6807

Cell: 408-605-5393

Fax: 408-297-6806

Morteza Ardalan